Providing quality health insurance is one of the biggest challenges for small businesses—but it’s also one of the smartest investments. In 2025, affordable health insurance quotes are more attainable than ever, thanks to government programs, flexible reimbursement models, and cost-saving innovations. Businesses with fewer than 50 employees can now balance rising healthcare costs while still offering meaningful benefits that support employee wellness and retention.

Why Small Businesses Need Health Insurance

Health insurance is no longer just an employee perk—it’s a strategic necessity. Offering coverage improves employee retention, boosts productivity, and strengthens your employer brand in competitive job markets. Modern plans emphasize preventive care, telemedicine, mental health services, and chronic disease management, helping employees stay healthier and reducing long-term absenteeism.

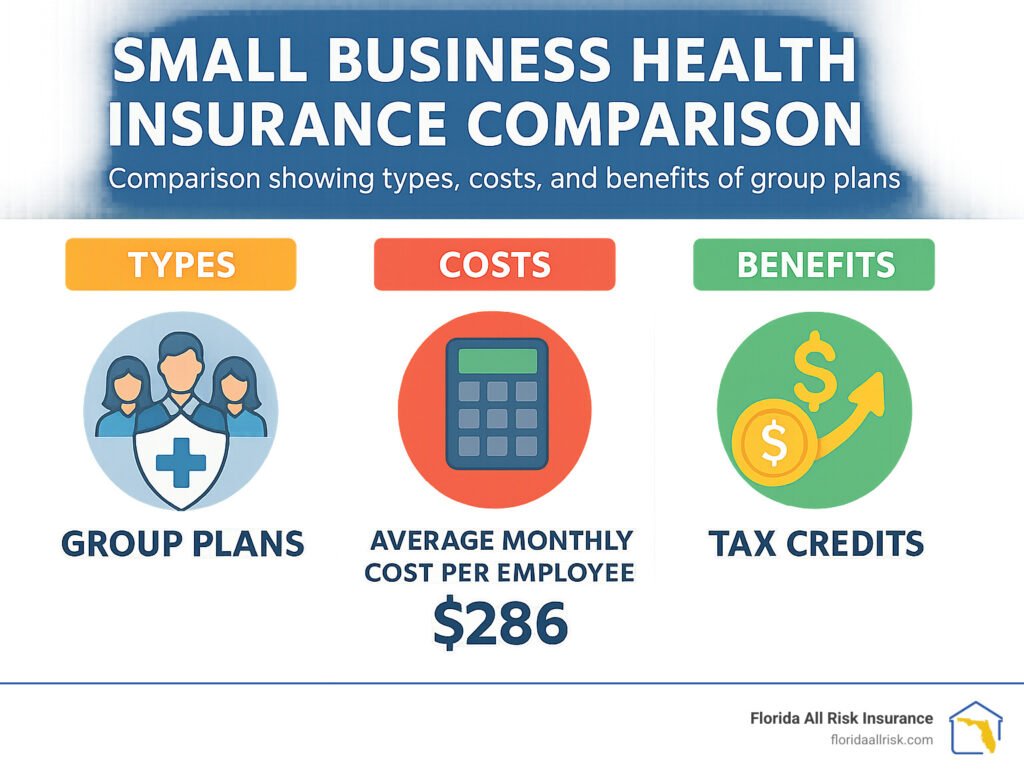

On average, affordable small business health insurance quotes range between $300 and $800 per employee per month, depending on location, coverage type, and provider network. These plans help employees manage everyday healthcare needs such as checkups, vaccinations, allergy treatments, and wellness support, leading to higher morale and a more engaged workforce.

Key Options for Affordable Coverage

Small businesses have several cost-effective health insurance options to explore:

- SHOP Marketplace (Small Business Health Options Program):

Designed for businesses with up to 50 full-time employees, SHOP allows owners to compare group plans from major providers like Blue Cross Blue Shield and Kaiser Permanente. These plans often include preventive care, telehealth services, and mental health coverage. - QSEHRA (Qualified Small Employer Health Reimbursement Arrangement):

Ideal for businesses with fewer than 25 employees, QSEHRAs reimburse employees tax-free for individual health insurance plans. This flexible option works well for startups and remote teams seeking customized coverage. - Health Sharing Plans:

These community-based alternatives can reduce costs by 30–50%, focusing on major medical expenses while supporting wellness initiatives related to fitness, nutrition, and preventive care. - Level-Funded Plans:

Combining predictable monthly payments with stop-loss protection, level-funded plans help businesses control budgets while still offering comprehensive coverage for unexpected medical needs.

Comparing quotes across these options often reveals significant savings, especially when preventive care and wellness programs are included.

Navigating Rising Healthcare Costs in 2025

Health insurance premiums for small businesses are expected to rise by around 11% in 2026, driven by inflation, workforce shortages, and increased use of high-cost medications. To offset these increases, businesses should prioritize plans that include telemedicine, wellness incentives, and preventive care benefits that reduce long-term claims.

Eligible employers can also benefit from the Small Business Health Care Tax Credit, which can cover up to 50% of premium costs for businesses with lower-wage employees. Encouraging employee wellness—through screenings, fitness programs, and nutrition guidance—can further stabilize premiums over time.

Steps to Get the Best Health Insurance Quotes

- Assess Employee Needs:

Survey your team to understand priorities such as mental health support, family coverage, or chronic condition management. - Compare Multiple Quotes:

Use licensed brokers or online platforms like SHOP to compare at least three to five plans, evaluating premiums, deductibles, and network coverage. - Explore Flexible Models:

Consider ICHRAs or QSEHRAs for businesses seeking customizable, tax-advantaged solutions. - Leverage Tax Benefits:

Contributing at least 50% toward premiums may unlock valuable tax credits. - Ensure Compliance:

Verify that plans meet Affordable Care Act requirements, including coverage for essential health benefits and pre-existing conditions.

Future Trends in Small Business Health Insurance

The future of small business health insurance is increasingly tech-driven and flexible. AI-powered telemedicine, app-based wellness tracking, and virtual mental health services are becoming standard features. Association Health Plans (AHPs) are also gaining popularity, allowing small businesses to pool resources and access lower rates.

As healthcare continues to evolve, businesses that embrace flexible, wellness-focused coverage options will remain competitive—offering employees affordable, comprehensive protection while keeping costs under control.