With car insurance premiums continuing to rise, finding affordable coverage quickly has become a priority for many drivers. In 2025, average full-coverage auto insurance costs climbed close to $2,700 per year, driven by higher repair expenses, inflation, and increased accident claims. The good news? By using the right strategies, you can compare quotes efficiently and secure reliable coverage without overpaying.

This guide breaks down practical, time-saving tips to help you get competitive auto insurance quotes from trusted providers—fast.

Table of Contents

- Why Comparing Auto Insurance Quotes Is Crucial in 2025

- How to Get Auto Insurance Quotes Quickly

- Using Discounts to Reduce Premiums

- Key Factors That Affect Your Insurance Quote

- Mistakes to Avoid When Comparing Quotes

- Fitting Auto Insurance into Your Financial Plan

Why Comparing Auto Insurance Quotes Matters in 2025

Auto insurance rates can vary dramatically between providers—sometimes by 40–50% for the same driver profile. In 2025, average full-coverage premiums hover around $2,100 annually, making comparison more important than ever. Online comparison platforms allow you to review offers from dozens of insurers in minutes, helping you identify better pricing, coverage options, and limited-time discounts without lengthy phone calls.

How to Get Auto Insurance Quotes Quickly

Before you begin, gather key information such as:

- Driver’s license details

- Vehicle Identification Number (VIN)

- Driving history

- Desired coverage limits

Use reputable comparison websites or insurer apps to enter your details once and receive multiple quotes instantly. Aim to review at least three to five quotes, comparing both price and coverage to avoid underinsuring your vehicle.

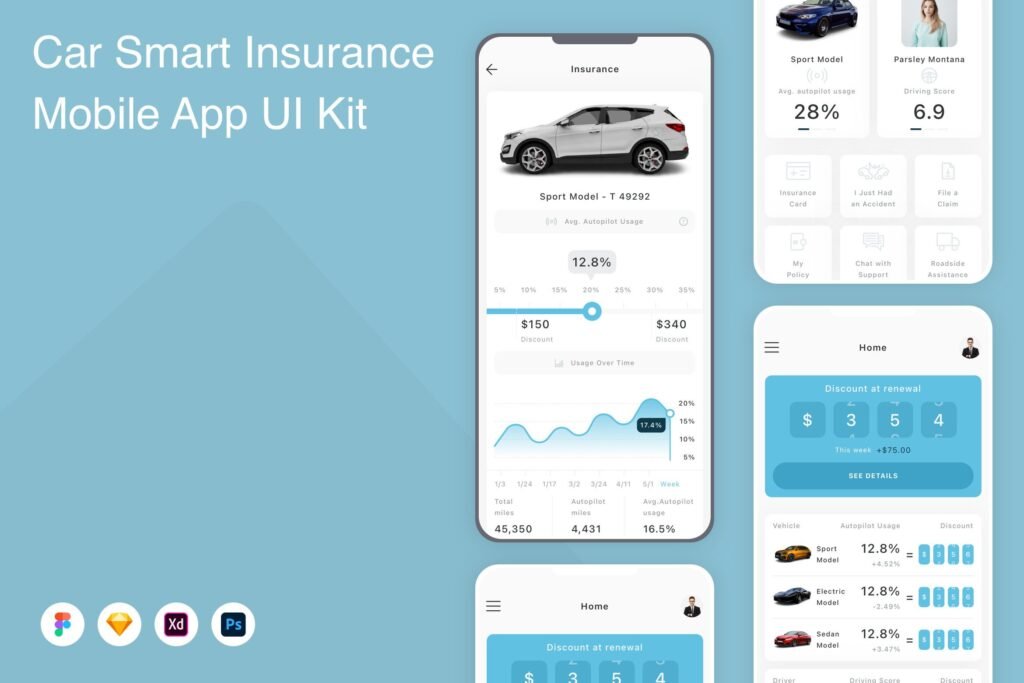

Many insurers now use AI-powered mobile apps that generate quotes in under five minutes. For best results, avoid peak renewal periods and look out for seasonal promotions that may lower premiums toward the end of the year.

Using Discounts to Reduce Premiums

Discounts are one of the fastest ways to lower your auto insurance cost—often cutting premiums by 10–25%. Common savings opportunities include:

- Safe driver or accident-free discounts

- Bundling auto and home insurance

- Good student discounts

- Usage-based or telematics programs

Improving your credit score can also help reduce premiums in many regions, as insurers associate higher scores with lower risk. Asking insurers directly about available discounts ensures you don’t miss easy savings.

Key Factors That Affect Your Insurance Quote

Several elements influence how much you pay for auto insurance:

- Location: High-traffic or storm-prone areas tend to have higher rates

- Deductible: Increasing your deductible can lower premiums by 10–15%

- Vehicle type: Cars with advanced safety features often cost less to insure

- Driving habits: Accurate disclosure of mileage and usage is essential

With insurers expected to moderate rate hikes to around 4–7% in 2026, proactive adjustments—such as choosing safer vehicles or reviewing deductibles—can make a noticeable difference.

Mistakes to Avoid When Comparing Quotes

Many drivers make costly errors when shopping for insurance, including:

- Choosing the cheapest policy without reviewing coverage limits

- Overlooking state-required minimum liability coverage

- Paying for add-ons already covered elsewhere, like roadside assistance

- Sticking with one insurer without re-comparing annually

Always verify details carefully—incorrect or missing information can lead to denied claims or policy cancellations.

Fitting Auto Insurance into Your Financial Plan

Auto insurance should be part of your broader financial strategy. As 2026 brings changes in savings rates, investment options, and retirement planning, reviewing insurance costs helps free up cash for long-term goals. Savings from lower premiums can support emergency funds, retirement contributions, or other financial priorities without sacrificing protection.

Final Thoughts

Finding affordable auto insurance doesn’t have to be time-consuming. By comparing quotes online, using available discounts, and understanding what affects your rates, you can secure the right coverage quickly and confidently. A little preparation today can lead to substantial savings and financial peace of mind tomorrow.